You may be eligible for monthly VA benefit payments if you are the surviving spouse or child of a service member who was killed while on active duty or died from a service-connected disability or had a 100 percent disability rating for a period of time before their death. There are different categories of benefit payments. Let's take a look at the two main survivor benefit programs: Dependents Indemnity Compensation (DIC) and accrued benefits. As you would expect, there are very specific requirements that must be met to qualify for tax-free DIC benefits. The deceased veteran must have passed away while on active duty, including during training, or their death must have been caused by a service-connected disability. Additionally, DIC benefits may be awarded if the service member passes away and has been receiving compensation for totally disabling service-related conditions for at least 10 years or for at least five years since discharge from active duty. If a widowed spouse has remarried before the age of 57, they are not eligible for dependents indemnity compensation. Furthermore, there are some additional requirements that must be met regarding the marriage and the ages of children, so it is best to consult with an accredited VA attorney. Parents of veterans who died as a result of a service-related injury or disease may also be eligible to receive a tax-free DIC benefit if their income is below a certain level. It is a common misconception that when a veteran passes away, their claims for disability benefits die with them. This is not true. Accrued benefits may be available to the survivor of a service member who dies while their claim for disability benefits is pending. Survivors of veterans who died on or after October 10, 2008, are allowed to take the place of the...

Award-winning PDF software

Va accrued benefits Form: What You Should Know

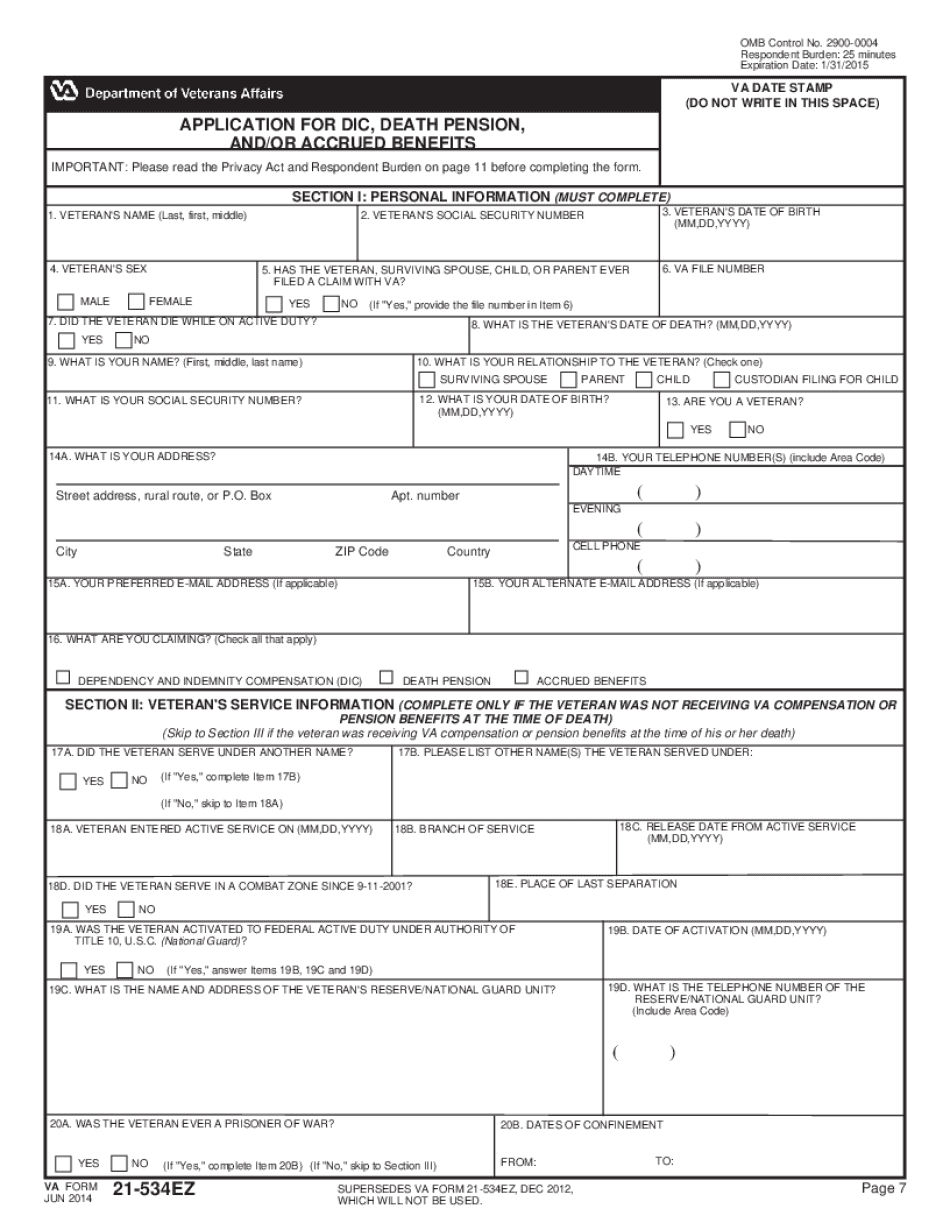

Benefits due to a dead veteran have to be made to the surviving spouse of the deceased Veteran only. Veterans who are no longer living can go at any time to request any accrued benefits. Benefits due to a dead Veteran can be made to his surviving spouse. That means that if the beneficiary is your spouse, then your spouse should be the recipient of benefits for the dependents claimed. If you're surviving spouse has no spouse in the United States, then make claims for benefits to the beneficiary who is currently residing in the United States. The beneficiary is not required to be the same as the deceased Veteran. An additional requirement is that there is no surviving spouse or spouse, if it is unclear who the surviving spouse is (e.g. your spouse passed away within the last five years or, you lost your spouse in any reason after January 1, 2010.) If you can, you will want to obtain a copy of the death certificate if at all possible to make certain that any benefits payable under the name of the deceased Veteran are actually paid. VA Form 21-534 requires that the name and social security number of the person making the claim be entered on the certificate of death. You must have the same document used to apply for benefits to claim the benefits. In the event of a marriage with no children, the spouse should not need to apply for the benefits from the surviving spouse and should report the information on their own form. If the deceased Veteran lived alone, VA Form 21-534 does not require the surviving spouse to appear in person or to file a claim. The benefits payable should include all amounts due for the veteran's dependents and children. If the surviving spouse has an annual income that is more than the veteran's annual pension, VA form 21-534 applies even if there are no dependents to receive any of the pension. The benefit is not taxable. However, if a Veteran has both dependents and an annual income over the highest amount, only the higher amount is taxable. If the surviving spouse claims benefits for the children, then it is important that the Veteran file a claim for his spouse and make a copy of his widow's/widower's tax return (SS-5 forms) to see if it is appropriate to claim the benefits.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va 21-534EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va 21-534EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va 21-534EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va 21-534EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Va accrued benefits form