Award-winning PDF software

Va 21 534 income limits Form: What You Should Know

This will give you an income of 23,932, which is higher than the MID. If you have a dependent child who is younger than 5 years old, then add 4,521 to the MAP in 2018. This will give you an income of 40,282. If you are a retired veteran with a pension, then you can choose to get a pension that does not include a monthly maximum and still qualify to be part of the Survivor Benefit Plan. To obtain a maximum pension in 2018, your income must come under the following limits for the year. Annual Income Limit for 2025 for the Qualified Survivor The Qualified Survivor is an individual who: Is 62 years or older than of December 31, 2025 ; Has served on active duty in the US military for at least one year and, At the time of separation from active duty, was assigned to the United States or a military dependent stationed in the US or, A dependent child has lived, for at least 3 months in their household. The maximum monthly amount that can be earned by the qualified individual is 5,723.50. A qualified individual can earn a maximum of 1,800.00 in pension benefits. Qualified Survivors can also receive income annuity payments in the amount of 743 per month. A survivor can also receive up to 2,150.00 per month as a non-taxable annuity. The monthly amount will go towards the monthly basic allowance. A couple must both be 62 years or older to qualify. The family must have been living together for at least 3 months and must also have both the surviving partner and the surviving children in the household at the time the divorce decree was filed. You can also apply to be part of a survivor bond in case your divorced spouse dies. A surviving spouse can receive a survivor's benefit in one lump sum, once they are at least 62. A surviving spouse can also receive a lump sum benefit of up to 2,000 per month. The lump sum benefit is not made available to dependents of the separated spouse. If you qualify, you will be required to submit one form to your local branch of the VA. The following is a link to fill out the form online. There is another form for those who are a member of the military.

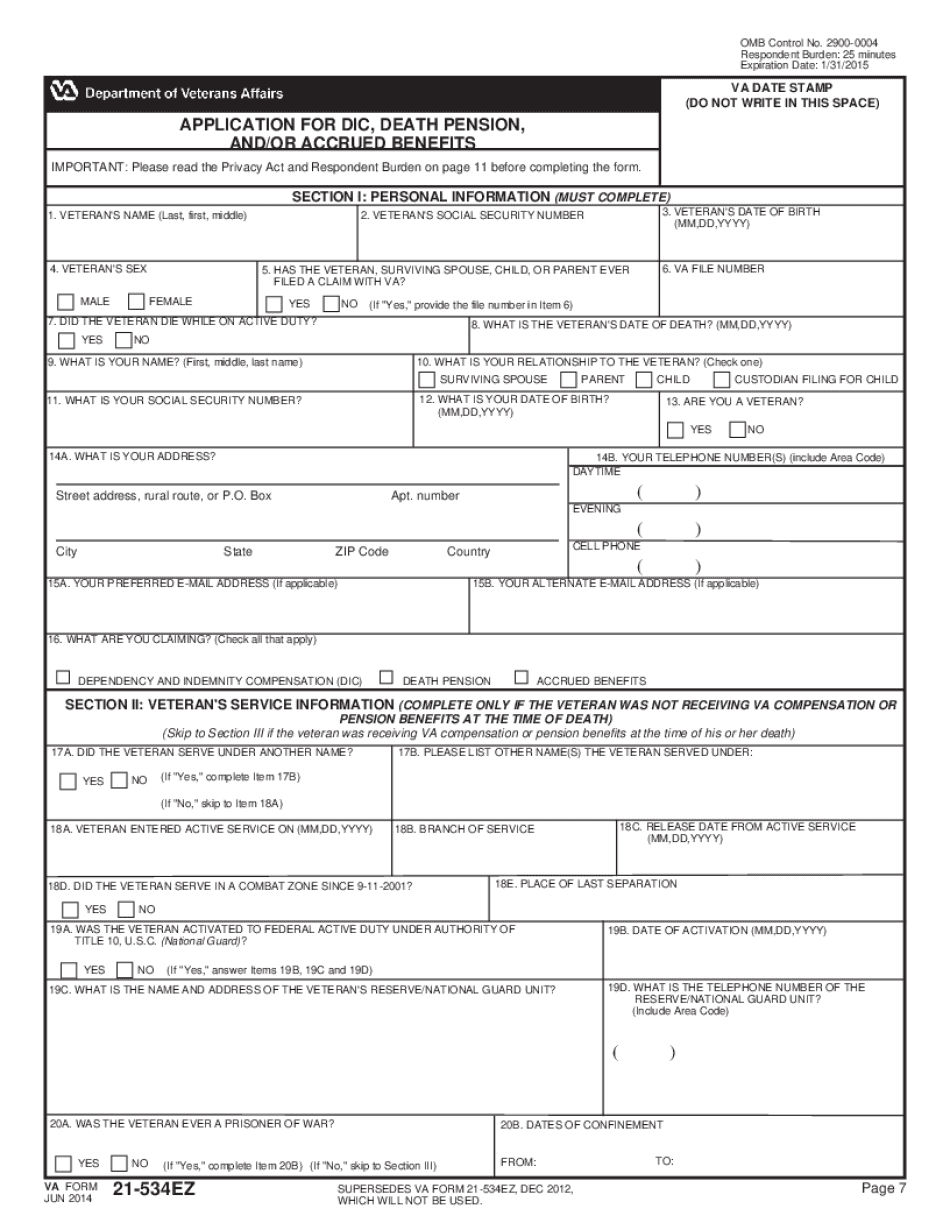

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Va 21-534EZ, steer clear of blunders along with furnish it in a timely manner:

How to complete any Va 21-534EZ online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Va 21-534EZ by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Va 21-534EZ from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.